TradingMarkets 4 Mining Stocks for Traders

If heightened demand for gold shares is a sign of flight to safety, then what are traders and investors to make of the sharply correcting gold and mining stocks we have seen in the markets for the past week?

To steal a line from a recent interview with the Vice President, how about “So?”

One of the joys of working in the short-term “sweet spot” of 5 to 8 trading days is that many of the concerns the bedevil investors and longer-term traders either do not matter to short-term traders or tend to “matter” in very different ways.

For example, even though many had been decrying the rise of gold and gold stocks as a harbinger of hyperinflation, seeing many of these stocks rolling over and gapping down severely seems only to have generated a new panic: “What’s wrong with the gold stocks?!” “Is a decline in inflation recessionary?!”

Still others have concluded that the pullback in gold shares–pullbacks that are taking place largely above the 200-day moving average, mind you–is the greatest opportunity to short precious metals stocks in a generation.

Fortunately, short-term traders–at least those whose style is similar to the TradingMarkets approach to trading–can sidestep these sorts of concerns and questionable trading approaches. Short-term traders following our approach can simply treat these falling gold stocks the way they would treat falling financial stocks or falling technologies stocks or falling international exchange-traded funds, for that matter: if they are above the 200-day moving averages, then their pullbacks are buying opportunities. If they are below their 200-day moving averages, then let them keep falling.

It sounds simple. But this sort of simplicity in trading is what helps make the difference between traders who can confidently look at the markets and assess where opportunity likely lies, and traders for whom every stock is a completely blank page for which reasons to buy or sell need to be generated anew. While the first trader has a basic sense of what to look for in any stock before even considering whether to buy or sell it, the second trader has to figure it all out over and over each time they run into a new stock.

Instead, with a simple filter–the 200-day moving average–and a simple operating premise of buying weakness and selling strength, the trading discipline almost explains itself. We want stocks that are above the 200-day moving average, but are pulling back toward it. This is the kind of weakness we want to buy–weakness in a broader context of strength (by virtue of the fact that the stock is trading above its 200-day moving average).

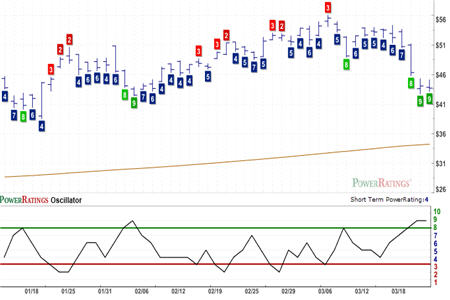

Here are four such strong stocks trading above their 200-day moving averages. All of the stocks in today’s report have Short Term PowerRatings of 8 or 9. Based on our research into short-term stock behavior–research that examined millions of simulated stock trades–we have concluded that stocks with Short Term PowerRatings of 8 have outperformed the average stock by more than 8 to 1 over the next five days. Stocks with Short Term PowerRatings of 9 have done even better, outperforming the average stock by more than 13 to 1 over the same time period.

Kinross Gold

(

KGC |

Quote |

Chart |

News |

PowerRating). Short Term PowerRatings 9. RSI(2): 2.44

Randgold Resources

(

GOLD |

Quote |

Chart |

News |

PowerRating). Short Term PowerRatings 9. RSI(2): 1.19

Taseko Mines

(

TGB |

Quote |

Chart |

News |

PowerRating). Short Term PowerRatings 8. RSI(2): 26.83

Hecla Mining

(

HL |

Quote |

Chart |

News |

PowerRating). Short Term PowerRatings 8. RSI(2): 15.25

Does your stock trading need a tune-up? Read our special, Free Report, “5 Secrets to Short Term Stock Trading Success” for a refresher course on not just why to buy low and sell high, but specifically how you can use intraday weakness in the market to do so. Click here to get your copy of “5 Secrets to Short Term Stock Trading Success” or call us today at 888-484-8220.

David Penn is Senior Editor at TradingMarkets.com.