TradingMarkets 5 Stocks for the Next 5 Days

Would a set of stocks that are likely to outperform the average stock by more than 8 to 1 over the next five days be something you would be interested in?

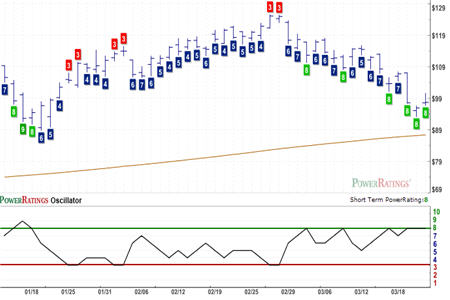

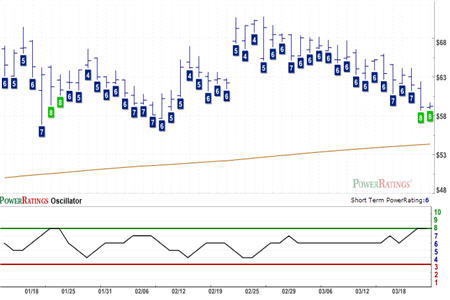

Our Short Term PowerRatings do just that for traders: identify those stocks, based on their trend, volume, momentum and volatility that are likely to outperform the average stock during what we call the short-term traders’ “sweet spot” from five to eight days.

Short Term PowerRatings were the product of extensive research into the behavior of stocks during this trading “window” in which most short-term traders have operated historically. We looked at millions of simulated stock trades between 1995 and 2007–including many stocks that have been since delisted–to try and discover a way of determining which stocks were more likely to outperform in the near term and which stocks were more likely to disappoint.

While the specific ingredients that go into our Short Term PowerRatings are understandably proprietary, our research has enabled us to quantify stocks in such a way that traders can be confident that those stocks that have higher Short Term PowerRatings values are better trading opportunities to the upside than stocks with lower Short Term PowerRatings. At the same time, traders who wish to sell stocks short can look to those stocks with the very lowest Short Term PowerRatings for potential opportunities to the downside.

Consider this: our research into short-term stock price behavior showed us that stocks with the highest possible rating in our PowerRatings system, a rating of 10, outperformed the average stock by a whopping 16.9 to 1 over the next five days. Stocks with Short Term PowerRatings of 10 do not appear every day. But when they do, they often represent outstanding opportunities for short-term traders looking to buy stocks that are likely to move higher in short order.

On the other end of the spectrum are our lowest Short Term PowerRatings stocks. These stocks, which have received Short Term PowerRatings of 1 or 2, are the kind of stocks that traders are often tempted to buy, but are in reality the sort of stocks that traders should avoid. Low Short Term PowerRatings stocks tend to be stocks that are overextended and overbought in the short-term. These stocks may be rallying up from major lows as part of a short squeeze, or they may even be a high-flying stock that is making news headlines every day. What is important is that, despite their bullish appearance, these stocks have tended to disappoint in our historical testing. In fact, the lowest of the bunch, the stocks with Short Term PowerRatings of 1 have actually underperformed the average stock by nearly 5 to 1 after five days.

Rather than buying low Short Term PowerRatings stocks, traders should avoid these names or, if they are open to selling stocks short, consider such low PowerRatings names as opportunities to bet against stocks whose temporary strength masks a broader context of weakness.

All of the 5 stocks in today’s report are the sort of high Short Term PowerRatings stocks that traders looking to buy weakness and sell strength should be interested in. All have Short Term PowerRatings of 8, which puts them in that class of stock that our research reveals have outperformed the average stock by approximately 8.3 to 1 over the next five days. I have also included the 2-period Relative Strength Index (RSI) values for each stock so that traders can see just how oversold these names are.

TXCO Resources

(

TXCO |

Quote |

Chart |

News |

PowerRating)

Silver Wheaton

(

SLW |

Quote |

Chart |

News |

PowerRating)

Petroleo Brasiliero

(

PBR |

Quote |

Chart |

News |

PowerRating)

Lihir Gold

(

LIHR |

Quote |

Chart |

News |

PowerRating)

Icon Plc ADS

(

ICLR |

Quote |

Chart |

News |

PowerRating)

For more simple and straightforward tips on short-term stock trading, by the way, consider getting a copy of our free report, written especially for those who trade stocks in the short-term “sweet spot” of five to eight days. Click here to get your copy of “5 Secrets to Short Term Stock Trading Success”–or call us at 888-484-8220–and see what the TradingMarkets approach to trading can do to make you a better trader.

David Penn is Senior Editor at TradingMarkets.com.