TradingMarkets Monday Stock Movers

The strength of recent days makes it little surprise that the stocks on our TradingMarkets Monday Stock Movers lists are among those that have moved the farthest the fastest.

Buying low and selling high is all about being in tune with the rhythms of the market, whether stocks are rising or falling. This approach to trading, true swing trading in our opinion, often means buying when the world is afraid of stocks and selling when the world can’t get enough stocks.

When stocks that are behaving just fine start being thrown out like garbage, we become interested. And when stocks that are in terrible shape start being treated like Olympic sprinters, we start betting that those names won’t reach the finish line–much less win the face.

None of this is controversial. In fact, it is the oldest wisdom on trading in the book.

What is unique is that we have quantified some of this time-tested trading insight, establishing a variety of technical indicators that traders can use to spot those instances when certain stocks can be bought low and sold high, and other stocks can be sold high and bought low.

TradingMarkets Monday Stock Movers is one of those indicators. We look at stocks that have moved up or down by 10% or more in the past few days. As far as we are concerned, there are two types of move that are of interest to short term traders. The first include times when strong stocks, stocks trading above their 200-day moving averages, lose 10% or more in a short period of time. We see these as buying opportunities, all else being equal.

The second, which includes the examples in today’s report, occurs when weak stocks, stocks trading below their 200-day moving averages, gain 10% or more in a short period of time. These stocks are stocks we believe traders should avoid or sell short. Our research into short term stock price behavior going back to 1995 revealed that stocks that were up by 10% or more over the past five days–and were trading below their 200-day moving averages–actually underperformed the average stock in one-day, two-day and one-week timeframes.

Click here to read our research into stocks that are up by 10% or more in a short period of time.

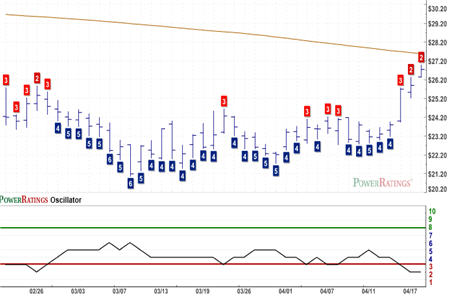

In addition, all five of the stocks in today’s Monday Stock Movers have Short Term PowerRatings of 2. Stocks with Short Term PowerRatings of 2, according to our research, have underperformed the average stock over the next five days. Note also that all five stocks have 2-period Relative Strength Index values of greater than 90, with one stock have a 2-period RSI in excess of 98.

AirCastle

(

AYR |

Quote |

Chart |

News |

PowerRating). RSI(2): 96.11

Dresser-Rand Group

(

DRC |

Quote |

Chart |

News |

PowerRating). RSI(2): 97.09

Emcorp Group

(

EME |

Quote |

Chart |

News |

PowerRating). RSI(2): 98.18

Overstock.com

(

OSTK |

Quote |

Chart |

News |

PowerRating). RSI(2): 95.87

Synaptics

(

SYNA |

Quote |

Chart |

News |

PowerRating). RSI(2): 91.02

Join Larry Connors, CEO and founder of TradingMarkets, Tuesday, April 22nd at 4:30 p.m. Eastern for a special presentation announcing the opening of our Swing Trading College. Our Swing Trading College has been one of our more popular products and we are happy to be making this 14-session, online course available to our readers and subscribers. The Conference Call will last for approximately 30 minutes.

Not only will Larry talk about the Swing Trading College, but also he will share with listeners a new method for swing trading exchange-traded funds, a strategy called “Double 7’s Strategy” that has performed impressively in historic testing, being correct over 79% of the time in both the NDX and the SPX from 1995 up through yesterday.

That’s Larry live Tuesday at 4:30 p.m. Eastern for the TradingMarkets Swing Trading College. Spaces are limited, so click here to reserve your spot today.

David Penn is Senior Editor at TradingMarkets.com.