TradingMarkets Monday Stock Movers: 3 Stocks for Swing Traders

Stocks are off to a soft start Monday morning. In the first half hour of trading, energy stocks – as well as basic materials names – are providing early leadership to the upside.

Although stocks have been trending only modestly lower since last Monday, we are seeing a distinct downward trend in the 2-period RSIs of the S&P 500, Nasdaq Composite and Dow industrials. Should this pattern continue, we are likely to see more oversold conditions and, consequently, the greater likelihood of a rally or bounce in the near term.

Our Short Term PowerRatings are reflecting this, as we would expect. Right now, our Top 25 PowerRatings stocks are divided between stocks with Short Term PowerRatings of 8 and stocks with Short Term PowerRatings of 7. This, at least anecdotally, indicates a relatively neutral market with few edges to the upside or downside.

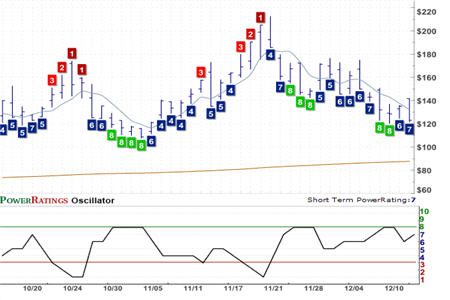

ProShares UltraShort Semiconductor ETF

(

SSG |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 7. RSI(2): 15.95.

Since it is Monday, one of the places we will look for additional edges is in our TradingMarkets Indicators, specifically, our roster of stocks that have been lower by 10% or more over the past five days. Our research indicates that these stocks, despite what traders may think, actually tend to produce positive returns in one-day, two-day and one-week timeframes.

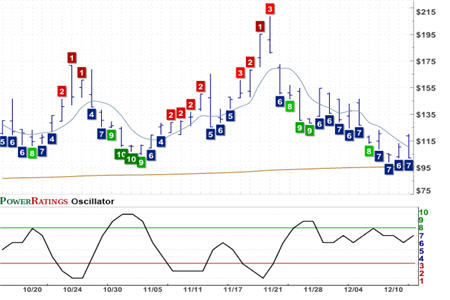

Rydex Inverse 2x Russell 2000 ETF

(

RRZ |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 7. RSI(2): 25.23.

Click the link below to read our research into stocks that have lost 10% or more over the past five days.

Why Strong Stocks Are Often the Worst Buy Candidates

Life Partners Inc.

(

LPHI |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 7. RSI(2): 18.71.

Included here are two inverse or short ETFs, as well as one stock, that are pulling back. Insofar as all three opportunities here have Short Term PowerRatings of 7, traders may want to keep an eye on these names – rather than move to take positions immediately. A higher market will likely make the short funds more attractive, whereas a pullback should encourage traders to pay more attention to stocks like LPHI – especially should the stock earn a Short Term PowerRating upgrade to 8 or higher.

According to a recent report, eight out of ten securities traded are exchange-traded funds. Want to learn how to trade them? Click here to find out what traders are saying about Larry Connors’ new book, Short Term Trading Strategies That Work: A Quantified Guide to Trading Stocks and ETFs!

David Penn is Editor in Chief at TradingMarkets.com.