TradingMarkets Monday Stock Movers: THOR, LDR, TCBK

Stocks are off to a slow start on Monday, following selling on Friday that brought stocks deeper into oversold territory.

There are Three stocks with Short Term PowerRatings of 8 or more that have also been down by 10% or more in the past five days. This is a potentially powerful combination of technical factors for short term stock traders looking for opportunities to buy into the recent weakness.

First, the high Short Term PowerRatings. Recall that stocks with Short Term PowerRatings of 8 have outperformed the average stock by a margin of more than 8 to 1 after five days. Stocks with Short Term PowerRatings of 9 have performed even better, besting the average stock by a margin of more than 13 to one over the same time period.

Click here to learn how to trade stocks using our Short Term PowerRatings!

When it comes to trading rules, we tend to think the fewer the better. But when it comes to edges, the more the merrier. This is why, in addition to looking for stocks with high Short Term PowerRatings, I also like to see if there are other technical factors that can help spot potentially the best of the best opportunities for trades.

Thoratec Corporation

(

THOR |

Quote |

Chart |

News |

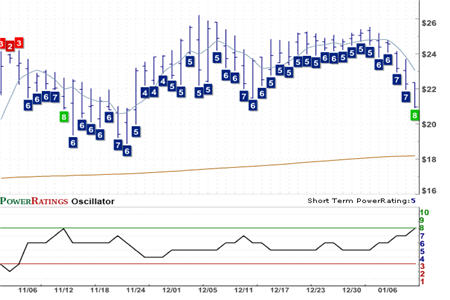

PowerRating) Short Term PowerRatings 8. RSI(2): 4.60

One of the basic technical screens I turn to is the “Down 10% or More” screen. This screen is part of our TradingMarkets indicators and builds from the research Larry Connors and Cesar Alvarez have done comparing the performance of stocks after they have pulled back to their performance after they have rallied.

Their conclusions were that, in the short term, stocks that are trading above their 200-day moving averages tend to produced positive results AFTER they have pulled back by 10% or more in five days. Read more about these conclusions in this research report here.

Landauer Inc.

(

LDR |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 1.39

This means that by finding high Short Term PowerRatings stocks that are trading above their 200-day moving average AND have pulled back by 10% or more, we will tend to be locating some of the best pullback opportunities in stocks in any given day.

Trico Bancshares

(

TCBK |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 1.26

Three such potential opportunities are presented here. Note that because these stocks are oversold, they are likely to attract buying interest at any time. Be sure to take a look to make sure that these stocks have not already begun to bounce as a result of buyers re-entering the market for these shares.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.