Upside bias until next week

Tuesday’s FOMC event went pretty much

by the script. One pre-news price swing, followed by decent directional action

once the guesswork crew got cleared out of their stops after the fact.

ES (+$50 per index point)

S&P 500 futures didn’t go anywhere on Monday

(chart not shown). If an ES trader worked real hard that day, they might have

scratched out a couple points profit in the end. Nothing wrong with that, but

why work so hard for so little? We knew Tuesday would offer solid profit

opportunity, and indeed it did.

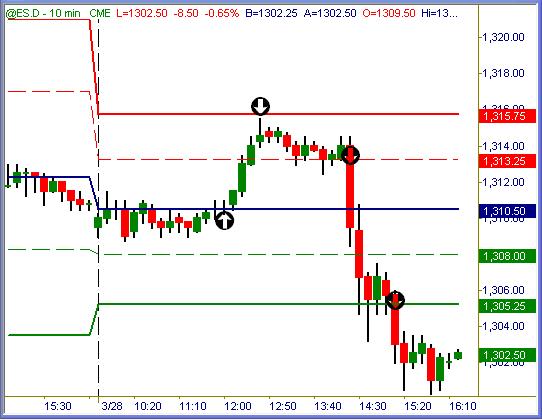

After an early exchange of shorts & longs

reversed near 1310 magnet, a long signal off the pivot finally worked for up to

+5pts at session highs near R2 resistance. Shorting that on a blind attempt

would have worked, especially since the ER and ES both topped at R2 values

together. When that type of dual hit happens, it usually marks a price turn.

As the FOMC news broke, hapless bulls who gamed

an end to interest rate hikes trampled each other in stopping out. Sell signals

confirmed at 1312.50 and again at 1304.50 offered solid profit potential inside

a normal day’s range of 15pts overall.

For those who play the “give me +2pts per day

and I’m done” approach, one session like yesterday (and last Tuesday, and

umpteen days each month forever) offers more than a week’s worth of yield in one

single session. Rather than beat ones brains in trying to trade the 5pt

micro-range mush, waiting for the normal to large-range sessions that happen all

the time offers a lot more potential for a lot less effort. Yesterday was one of

those, and certainly not the last.

ER

(+$100 per index point)

Russell 2000 futures were even better, as usual.

Longs off the pivot were available, short from R2 before the news and/or

confirmed sell signals 761+ and then 758 ~ 757 dual triggers offered well over

+10pts potential intraday. That’s a decent week of gains, contained within one

normal range session.

ES (+$50 per index point)

S&Ps are testing light support levels inside

the recent lo-hi swing grid. 1295 zone of 62% and the 50dma are likely to be hit

now that price action is so close… probable to be visited today. Expect a big

reactionary bounce off that dual confluence of key support if/when hit.

ER

(+$100 per index point)

Small caps are the buyer’s favorites, of

course. Still well above all meaningful support magnets and likely to be propped

into the end of this week – month – quarter. Upside or sideways has the nod

until next week, barring any unknown catalysts outside the market as of now.

Summation

FOMC is cleared, some economic reports left at week’s end, and the usual window

dressing antics are expected. Unless something thwarts their efforts, expect big

funds with performance sheets to protect keeping markets propped thru the

closing bell on Friday. Next two sessions should offer solid trading

opportunity, with slight upside bias along the way. As always, we trade the

clear method signals and enjoy the law of large numbers actuarial favoritism

provided by performing trade methods. Everything else is a distant second to

trusting your clear method signals.

Trade what you see, ignore what you believe and

optimal performance will result!

Trade To Win

Austin P

(Online video clip

tutorials…

open access)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.