Upward biased trading range

This week’s combined two inflation reports gave the market

something to celebrate about as inflation pressures did not grow as much as

feared, although rent inflation has yet to subside and may still cause

stickiness in inflation gauges in next months reports. Stocks AND bonds have

rallied nicely as a result of the lower than expected inflation numbers. However

this week’s reports also confirmed that a slowdown in growth is underway in the

US. Slower inflation and growth are certainly positive for bonds. And if indeed

the Fed has clearly stopped tightening for good, stocks may have reached a

bottom. But we suspect that the market will have difficulty embarking on a

sustainable and broad-based move higher as long as a slowdown is underway. There

are risks of a recession developing, especially considering the weakness in

housing indicators — and these may have knock on effects on consumption that

will grow. Stocks may well face a temporary period of concern about earnings as

growth slows more substantially than anticipated.

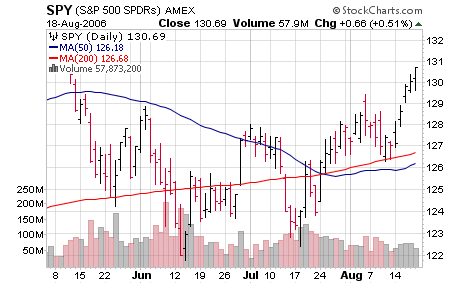

We still suspect a growth-scare lies ahead. While the S&P has broken above a

triangle with an upside target of around 1320 and more strength may lie ahead as

this objective is achieved, we are not convinced that the macro environment is

conducive to a sustainable new up-leg in stocks. And as long as the breadth of

our Top RS/EPS new highs breaking out and meeting our up fuel criteria do not

expand markedly, we will continue mostly on the sidelines.

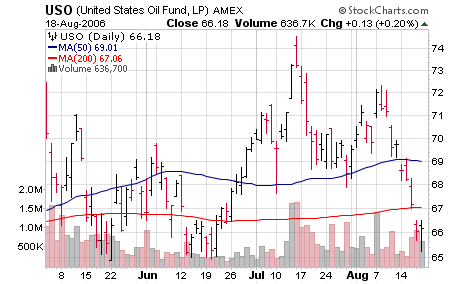

UN 1701 has installed a temporary peace in Lebanon and if USO breaks down below

64.5 on good volume it will confirm an intermediate-term top in oil prices. A

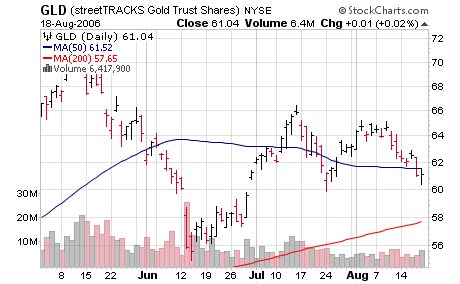

GLD strong volume close under 59.5 would help confirm a peak in these two key

commodities and likely mean more downside in commodity indexes that are already

weak. Weak commodities would be another expected confirmation of the growth

slowdown we’ve been warning about for some time. Such moves would also imply

that markets are anticipating that the War in Lebanon is on ice over the

short-term.

However, beyond the short-term, investors need to be prepared for a potential

ultimate failure of UN 1701. It could come rather quickly, or it could fester

for months or even years, but the odds are that further conflict will develop

because UN 1701 doesn’t truly disarm Hezbollah, and Hezbollah is religiously

intent on wiping out Israel. Moreover the incentives for terrorism have

increased radically as a result of UN 1701 preventing Israel from wiping out

Hezbollah. Terrorism and fanaticism are likely on the rise, as is anti-US action

in the Middle East. The world may have pushed a temporary peace on Israel that

will only insure a larger more prolonged and possibly wider conflict down the

road. And a monkey-wrench of increased terrorism risk has been thrown into the

investment mix. Such an increase in potential risk is not likely to be positive

for equities long-term.

Investors should continue to skeptically let market action be the guide. Strong

rallies in the major averages accompanied by high volume to create a couple more

follow-through days would be the first sign of more upside ahead. The real

excitement may not come until the breadth of Top RS new highs starts to expand

broadly and stocks meeting our runaway up fuel criteria begin to break out with

some plurality. Until then, we still suggest keeping your powder mostly dry. The

markets are celebrating this week, but we suspect breaking above 1320-27 and

making new highs will become more difficult unless better volume and breadth

materializes. We continue to regard this as a TREACHEROUS ENVIRONMENT where

CAPITAL PRESERVATION SHOULD BE PARAMOUNT. Don’t allocate heavily to anything

that doesn’t scream at you.

Sometimes the sidelines are the best place to be. We suspect we’re still in one

of those times. Conflicting forces continue to grow, and high odds sustainable

moves don’t appear likely to materialize just yet. Until they do, we suggest

mostly keeping your powder dry and watching events transpire closely.

Our model portfolio followed in TradingMarkets.com with specific entry/exit/ops

levels from 1999 through May of 2003 was up 41% in 1999, 82% in 2000, 16.5% in

2001, 7.58% in 2002, and we stopped specific recommendations up around 5% in May

2003 (strict following of our US only methodologies should have had portfolios

up 17% for the year 2003) — all on worst drawdown of under 7%. This did not

include our foreign stock recommendations that had spectacular performance in

2003.

Our US selection methods, our Top RS/EPS New Highs list published on

TradingMarkets.com, had readings of 10, 8, 22, 26 and 36 with 18 breakouts of 4+

week ranges, no valid trades meeting criteria, and no close calls. This week,

our bottom RS/EPS New Lows recorded readings of 47, 24, 18, 19 and 10 with 7

breakdowns of 4+ week ranges, no valid trades and no close calls. The “modelâ€

portfolio of trades meeting criteria has some time back exited all positions and

is 100% in cash.

Mark Boucher has been ranked #1 by Nelson’s World’s Best Money Managers for

his 5-year compounded annual rate of return of 26.6%.

For those not familiar with our long/short strategies, we suggest you review my

book “The Hedge Fund Edge“, my course “The

Science of Trading“, my video seminar, where I discuss many new techniques,

and my latest educational product, the

interactive training module. Basically, we have rigorous criteria for

potential long stocks that we call “up-fuel”, as well as rigorous criteria for

potential short stocks that we call “down-fuel”.