Was yesterday’s move an over-reaction?

Tuesday’s session delivered the wild

volatility akin to last year AND a breakout from the recent stale range. Indexes

traded back to recent 2005 highs in what amounted to a short squeeze = panic

buying of dramatic proportions. More on that later… first, let’s see what

yesterday offered and likewise what today may have in store:

ES (+$50 per index point)

S&P 500 futures were shorts early that worked

for +8ps maximum downside. A second short signal on the subsequent lift failed

to go anywhere. Buy signals flashed thru midday ahead of FOMC news, where there

was a delayed response before the big launch upward toward recent highs.

Today’s low is likely to hold above 38% retrace

of this swing, which happens to be near the daily pivot point (not shown) as

well. Indexes might not make it down that far but if they do, buying should halt

such a drop if upside has further potential from here.

YM (+$20 per index point)

Dow futures offered shorts early, shorts midday

but then burst out of a bearish alignment without clear warning. Dow traders

could have hit buy orders in breakout fashion as this symbol lagged all others,

that was about it.

Today’s low should hold 10835 if touched,

sparking a new round of buying in that scenario.

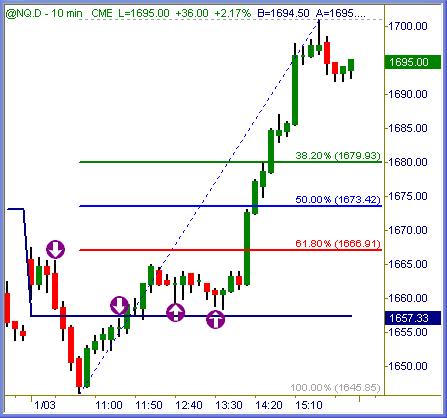

NQ (+$20 per index point)

Nasdaq 100 futures were shorts early, shorts

mid-morning and then buy signals near 1660 midday. Session highs were a whopping

(for this symbol) +40pts higher from long signals near the close. That used to

be a very common range for the NQ… but one we seldom see in times of floor

level VXO readings.

1680 should likewise be today’s bottom if

touched for the same reasons described above.

ER

(+$100 per index point)

Russell 2000 futures were their usual jumpy

selves yesterday. Buy signal off the opening print (no arrow) as discussed in

the live room worked +1.5pts to +2.0pts depending on exact fill… price action

whips all around off the bell in this wild one here.

From there it was a sell signal that worked for

+2.5pts in favor, bounced from light support back up thru original entry,

offered another short signal above 680+ and subsequently dove 10pts lower from

that sequence.

Whether trades held one, two or even three

attempts depended on how an individual managed trades: some scalp out for +2pts,

some trail stops tighter than others, some enter and let thing run… every

individual trader is different. No two manage any sequence of trades alike. That

is a universal law = fact in our profession, and this example demonstrates how

any two ER traders out of ten could have experienced vastly different results by

11:00am est yesterday.

From there ER failed at its continuation sell

signal and then offered quick buy signals following the FOMC report. It was

straight up thru the roof from there once buyers cooked the shorts to a crispy

golden brown hue.

Today’s lower support for ER near 681+ should

hold any potential test there.

Summation

This is the third time in a row that FOMC minutes caused much more

market stir than the actual meeting itself. Yesterday’s over-reaction probably

had as much to do with clean slate of 2006 for big money players as the “news”

itself.

Speaking of which, did the Fed state that

interest rate hikes had come to an end? I read where the minutes stated that

rate hikes were probably nearing an end. Is that a news flash to anyone in this

industry? I mean, come on now! The Fed stating rate hikes won’t last much longer

is like saying bare ground here in western NY state won’t last forever. I live

right between Rochester, Buffalo and Syracuse in a triangle on the map. Each

city is good for 100+ inches of snow annually. Right now the ground here is

bare. I proclaim that won’t last much longer. Should that cause the masses here

to rush out and buy snow shovels? Please!

Upside clearly has the nod for now, and it is

of course high odds to see an early long trade work profitably this morning.

That said, yesterday’s over-reaction to known facts is capable of reversal

failure. We’ve seen many days like yesterday totally undone in the next session

or three. Could happen. Trend is up until proven otherwise, but that stilted

ramp on first trading day of this year is not one of rock solid support to build

upon. Time will tell.

Bias is long until proven otherwise, and we’ll

let the charts alone prove to us which direction has merit from here.

Trade To Win

Austin P

(Weekend Outlook trend-view section…

open access)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.