Watch this pattern if you want to know the next move for the SPX

Pre-market futures are slightly green,

which predicts the opening wiggle may be a tad higher on initial prints. From

there it is anyone’s guess, which is when we turn our trade entry decisions over

to technical analysis tools.

ES (+$50 per index point)

S&P 500 is forming a bearish rounding top…

same pattern market bulls would call a bullish rounding bottom if this chart

were inverted. Yesterday’s micro-range tested 50% of the most recent swing and

closed above the 38% mark. Below 671 is bearish, and for now the sideways

consolidation since Tuesday continues.

MD (+$100 per index point)

S&P 400 also tested and closed right on its 38%

of the most recent lo-hi swing. At $100 per index point, this symbol trades

somewhere between ES and ER in terms of methodical action and dollar value range

intraday. Upside has the nod until 716 is broken, with 711.50 at recent lows

next visible target from there.

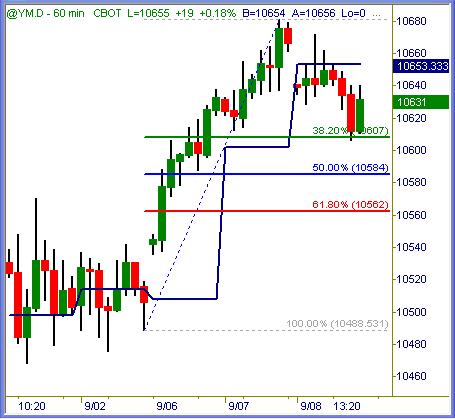

YM (+$5 per index point)

Dow Industrial futures likewise held a test of

their 38% retrace, same general rounding top pattern of consolidation appears

visible. 10560 is the line of demarcation for bulls / bears unless new recent

highs are posted first.

ER (+$100 per index point)

Russell 2000 futures dipped to their 50%

retrace akin with ES, then squeezed a couple points higher into the closing

bell. Not much more to infer here than that… with 671 an important line on the

chart for whether the current bounce off Katrina lows will stick or fail

accordingly.

{Price levels posted in charts above are

compiled from a number of different measurements. Over the course of time we

will see these varying levels magnetize = repel price action consistently}

Summation

Overall, stock index markets are digesting last week’s normal ranges

and volatility levels. This week has slipped back into below-normal intraday

ranges and sideways congestion patterns. It has been a profitable three-day

sequence, although not nearly to the degree of previous two weeks before. We’ll

see if Friday’s session can break the doldrums or merely wind price action into

a tighter coil due to break with emphasis real soon.

Next up is the weekend educational piece, which

I’m working on right now. It will cover discretionary methods, rule-based

systems and probably several other rabbit trails I’m apt to wander down. See you

then!

Trade To Win

Austin P

(free pivot point calculator, much more inside)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.