Weary Monday is here

The currency market is weary from reacting to breakouts

(i.e. Friday) only to have the markets reverse. It has now been six

months of choppy trading with declining volatility — most measures are at an

all-time and currency managers/traders are challenged.

Will the

sideways and difficult trading continue into the end of the year as it has

during the past two, or will reduction of positions as the end of the year

approaches mean we will finally see a trend?

Our

thoughts: while trading has been back and forth for the last couple of months,

we are optimistic that a trend/higher volatility will develop in the last 2

months of the year. Clients may consider reducing lot size on a per trade basis

until conditions do improve as a way to insulate against choppy conditions.

EUR/CHF:

We are looking to establish a long in EUR/CHF if it trades down to the 1.5886

level with a 25 pip stop-loss. Let’s see what happens when the markets open

later this afternoon before we place the order with the dealer.

EUR/JPY:

EUR/JPY continues to be an interest on the short-side. As

mentioned however, if the appetite for carry trades continues, this cross will

not remain weak for long. As a result, clients wishing to play this one to the

short side may consider a wider stop-loss with a reduced lot size.

The 149.75-80 level did hold in late

New York

trading and managed to close slightly lower (149.67). The key breaks in support

at 149.50 & 149.30 will be the expected catalysts for lower levels. We still see

150.10 and 150.50 as the logical stop-loss levels.

AUD/USD: There appears to be no signs

of risk aversion waning (i.e. continued carry trades) despite a consistent push

higher in AUD/USD to short-term overbought levels. As such, .7650 seems likely

to hold on any pull-backs and would likely offer a decent long entry with a

stop-loss below .7585

Upside targets are seen at .7710 &

.7750-75

EUR/USD:

Look for 1.2770-80 to be the key resistance/closing levels that

will determine if the current move higher in EUR/USD can continue into

mid-November. Conversely, 1.2645, and to a lesser extent, 1.2715, should provide

support.

NZD/USD:

Continued strength on Friday suggests that kiwi is still in play

and will likely move higher in the days to come. Minor pull-backs towards .6595

are possible, but this level should hold, and prices could track towards .6670 &

.6725 by weeks end.

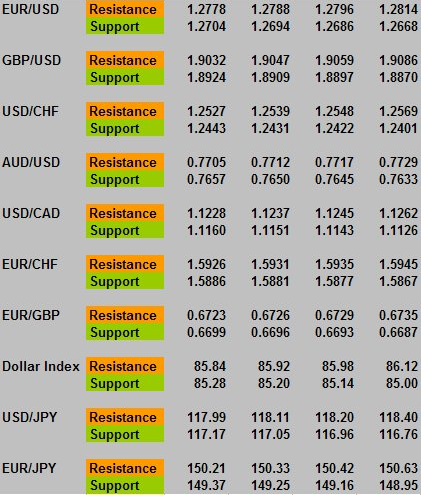

Short-Term Reversal Levels (STRL’s):

valid through 10/30 at 21:00 GMT

As always,

feel free to send me your comments and questions.

Receive a

free sampling of our intra-day FX analysis and trade alerts –

Launch

FX Desktop Ticker

Dave Floyd is a professional FX and stock trader based in Bend, OR and the

President of Aspen Trading Group. Dave’s approach to FX combines technical

and fundamental analysis that results in trades that fall into the swing

trading time frame of several hours to several days. For a free trial to

Dave Floyd’s Daily Forex Alerts

or call 888.484.8220 ext. 1.