What’s Up, What’s Down: Bearish on the Euro and Swiss

Comments for Thursday, December 10, 2009

Looking Ahead to Today by Reflecting Back at Wednesday’s Price Action

CURRENCIES:

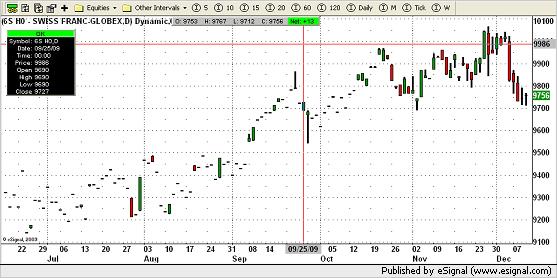

Higher closes yesterday for the Japanese, British pound, Canadian dollar, Euro Fx and Swiss franc while lower for the British pound and US Dollar index. The euro and franc closed higher but still should work lower after giving me sell signals on Monday and making its lowest lows since the first week in November. There is good resistance over 14800 for the euro and 9800 for the franc. The yen continued its upward momentum with its third strong close in a row. Still the yen has been hurt by its action on November 27th. The Canadian dollar continued its choppy sideways pattern since early September closing higher this time while still in a gradual up-trend. The pound making its lowest low and close since the middle of October. The Aussie dollar closed higher seemingly working sideways since October while still in a long-term up-trend overall. The dollar closed lower after making its highest high since November 4th in reversal type action. However, the dollar now acts like it will work higher with the 7700 area, basis the March contract, my first objective.

See the balance of my morning comments, including the Metals, Softs, Energies and Grains, at my website. For my complete coverage, visit my commentary page at www.markethead.com.

Rick Alexander has been a broker and analyst in the futures business for over thirty years. He is a Vice-President for Sales and Trading at the Zaner Group (www.zaner.com) a Chicago-based futures brokerage firm. If you would like a free booklet explaining the charts mentioned above, email Rick at ralexander@zaner.com.

The information in this Report and the opinions expressed are subject to change without notice. Neither the information nor any opinion expressed constitutes a solicitation by Rick Alexander or the Zaner Group of the purchase or sale of any futures or options. Futures and options trading is speculative in nature and involves risks. Spread trading is not necessarily less risky than outright positions. Futures and options trading is not suitable for all investors.