What’s Up, What’s Down: Bullish Turn for the Euro and Swiss Franc

Comments for Monday, May 11, 2009

FINANCIALS: 05/08/09

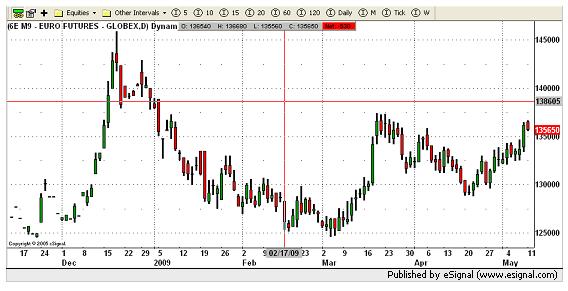

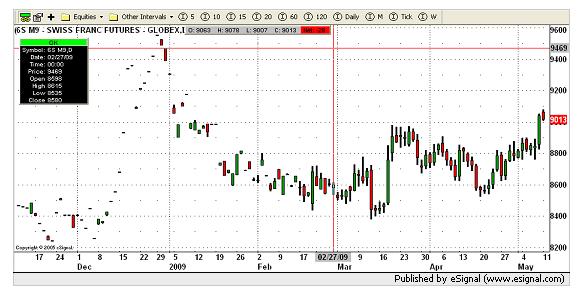

We saw higher closes for the Euro Fx, Aussie Dollar, Canadian Dollar, British Pound, Swiss Franc and Japanese Yen Friday, while lower for the dollar index. Strong closes for the euro and franc have given me buy signals for both of these currencies. The yen closed higher also but is still in a downtrend but now attempting to form a possible bottom. The Canadian Dollar continued making new recent highs and closes after Thursday’s lower settlement also eliminating a possible reversal. The pound also made a new recent high and close quickly ending reversal type action.

The Aussie Dollar, on the other hand, continued making new recent highs and closes since last October once again leading the way higher for the rest of the currencies. The dollar index made a new recent low and close continuing its downtrend. I am holding Buy Signals for the Euro, Franc, Canadian & Aussie dollar and Pound.

FINANCIALS: 05/11/09

Last Friday, eurodollars and notes closed higher, while lower for the bonds. The eurodollar made another(4th trading session in a row) recent high and close continuing its uptrend while the bonds made its lowest low and close since last November. The notes, however, continue holding the critical 120 area basis the June contract even after making its lowest low since late February. I am holding a Sell Signal for Bonds.

GRAINS: 05/11/09

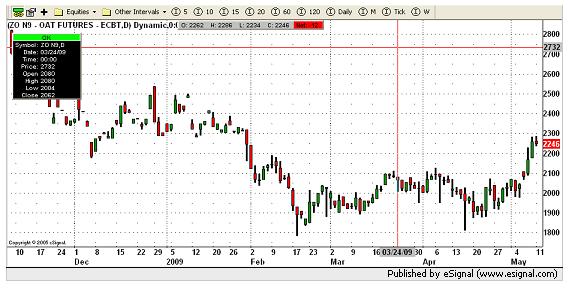

With the exception of rice and soybean meal, the grain complex all closed higher last Friday. Wheat made new recent highs and closes continuing to look higher led by Minneapolis. Corn took out and settled above the important 418 basis the July contract and, although this grain is being helped up by the beans and to a lesser extent the wheat, technically this grain is also in an uptrend started by a double bottom at 370 basis the July contract. Oats followed through with another strong close (highest high and close since the beginning of February. There is good resistance between 230 and 250 in the July contract. The beans complex settled mixed but the oil made a new recent high and close and look bullish along with the beans and meal. I am holding Buy Signals for Beans, Wheat and Corn.

See the balance of my morning comments, including the Metals, Softs, Energies and Grains, at my website. For my complete coverage, visit my commentary page at www.markethead.com.

Rick Alexander has been a broker and analyst in the futures business for over thirty years. He is a Vice-President for Sales and Trading at the Zaner Group (www.zaner.com) a Chicago-based futures brokerage firm. If you would like a free booklet explaining the charts mentioned above, email Rick at ralexander@zaner.com.