What’s Up, What’s Down: Financials in the Spotlight

Comments for Thursday, August 26, 2010

Looking Ahead to Today by Reflecting Back at Wednesday’s Price Action

Futures and options trading is speculative in nature and involves substantial risk of loss. Futures and options trading is not suitable for all investors.

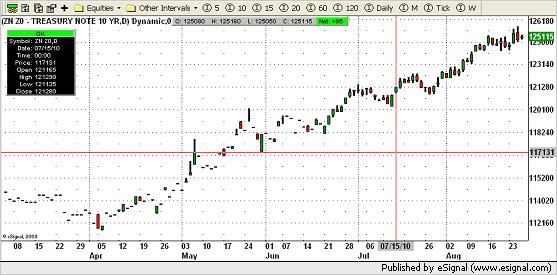

FINANCIALS:

Lower closes Wednesday for the Eurodollars, notes and bonds. The Eurodollar had a large range and its biggest drop for one session in quite a while. Also, the December contract has a DOUBLE TOP at contract highs and needs to hold the 9950 area. The notes and bonds made new CONTRACT HIGHS and closed lower in reversal type action. I realize everyone is looking for a top in the financials which also helps this market move higher. Call for details if you don’t understand. However, the double top in the Eurodollars and the reversal type action for the notes and bonds can’t be ignored. BUY SIGNALS FOR THE EURODOLLARS, NOTES AND BONDS. CALL FOR DETAILS!

There has been a lot of talk and advertising for Gold exchange traded funds (ETFs). Do you understand the difference, from a trader’s point of view, between gold futures and gold ETFs? Download my comparative evaluation report at https://www.zaner.com/3.0/ralexGold.asp.

Rick Alexander has been a broker and analyst in the futures business for over thirty years. He is a Vice-President for Sales and Trading at the Zaner Group (www.zaner.com) a Chicago-based futures brokerage firm. Email Rick at ralexander@zaner.com.

The information in this Report and the opinions expressed are subject to change without notice. Neither the information nor any opinion expressed constitutes a solicitation by Rick Alexander or the Zaner Group of the purchase or sale of any futures or options. Futures and options trading is speculative in nature and involves risks. Spread trading is not necessarily less risky than outright positions. Futures and options trading is not suitable for all investors.