What’s Up, What’s Down: Higher Greenback

Comments for Thursday, June 25, 2009

Looking Ahead to Thursday by Reflecting Back on Wednesday’s Price Action

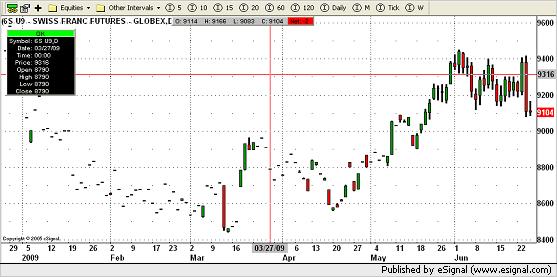

Higher closes yesterday for the Aussie dollar and dollar index while lower for the Euro Fx, Swiss franc, British pound, Japanese yen and Canadian dollar. The euro and franc started higher and then sold off sharply with the franc actually giving me a sell signal. My sell signal for the euro is still in place but it has been struggle for this currency in either direction over the last few weeks. Long term the euro is still in an uptrend and hasn’t, at least yet, done what I expected it to do when I got my signal to go short. The jury is still out on this one. The yen closed lower but still should work higher as its been doing gradually since its lows in early April. The Canadian dollar closed slightly lower with minor support around 8600 basis the September contract. The pound also settled lower but still should test its highs. The Aussie dollar closed lower but still in an uptrend needing to not close below 7800 which would give me a sell signal unless the chart formation changes before that happens. The dollar closed higher but looking to continue lower overall after its failed triangle on Tuesday.

FINANCIALS:

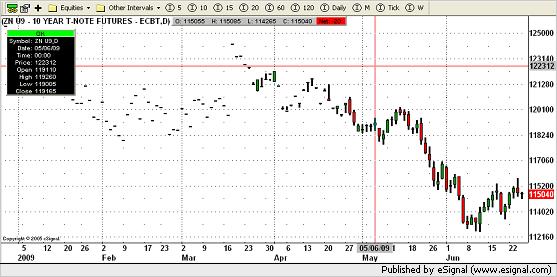

Higher close on Wednesday for the eurodollar while lower for the bonds and notes. The eurodollar is still in an uptrend making its highest close since June 3rd once again acting like it will test its highs. The bonds and notes made new recent highs before settling lower but no changes at this time. The bonds look higher and the notes are close to giving me a buy signal.

GRAINS:

Reports Today: Export Sales, Concensus Crush. We saw higher settlements for soybeans, soymeal and soyoil while lower for rough rice, oats, corn, Minneapolis, Kansas City and Chicago wheat. All of the wheat continue to look very weak making new recent lows and closes. Corn settled lower now in a bear flag needing to hold the 400 area which is a huge psychological price. Corn, however, is in a strong downtrend at this time but does have good support underneath. Rough rice settled still in a trading range between 12000 and 13000 even turning to the September contract. Its long term trend has been down since last September however. Oats closed lower in a fairly wide trading range now in a larger bear pennant looking lower overall but still in a good support area. The bean complex closed higher again but still looking lower overall with oil leading the way down at this time.

See the balance of my morning comments, including the Metals, Softs, Energies and Grains, at my website. For my complete coverage, visit my commentary page at www.markethead.com.

Rick Alexander has been a broker and analyst in the futures business for over thirty years. He is a Vice-President for Sales and Trading at the Zaner Group (www.zaner.com) a Chicago-based futures brokerage firm. If you would like a free booklet explaining the charts mentioned above, email Rick at ralexander@zaner.com.