What’s Up, What’s Down: Major Currencies Bullish Against Dollar

Comments for Wednesday May 27, 2009

CURRENCIES:

Higher closes on Tuesday for the Canadian dollar, British Pound and dollar index, while unchanged for the Aussie dollar & lower for the euro, franc and Japanese Yen. The euro and franc continue to look higher along with the Canadian dollar(new recent high and close), pound(new recent high and close) and Aussie dollar(new recent high). The yen settled lower again but has held up well against the spreaders selling the yen against the euro and franc which is usually what happens in bull currency markets. The yen also is in an uptrend although lagging far behind do to spread trading as mentioned above. The dollar settled higher but near session’s lows still looking very weak overall. I still maintain Buy Signals for all the major currency futures contracts (except of course, for the Dollar Index).

FINANCIALS:

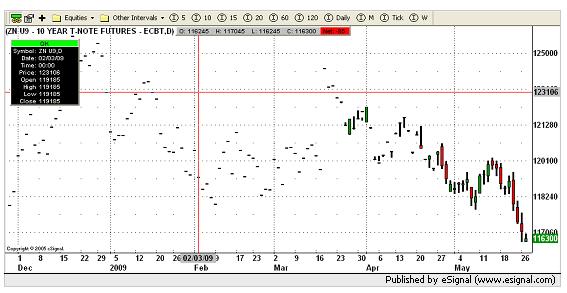

Lower close yesterday for the eurodollars, notes and bonds once again as I’m not trading the September contracts in financials. The eurodollar has little support down to the 9900 area at this time but the trend is still higher. New recent lows and closes for the bonds and notes again as their declines continue. I have Sell Signals for Bonds and Notes.

GRAINS:

Higher closes for Minneapolis and Kansas City wheat along with soybeans and soymeal while lower for Chicago wheat, oats, corn, soyoil and rough rice. All of the wheat continue to look strong overall with Minneapolis and KC making new recent highs and closes while Chicago wheat made a new recent high before settling slightly lower. Corn settled lower and, although still in an uptrend, buying breakouts instead up retracements may not be prudent at this time since it seems to be getting dragged higher by the bean complex at this time. Rice had its lowest close since the day(Mar. 16th) it made contract lows. Oats settled lower still needing to close over 250 basis the July contract to break out of its resistance area. However, this should only be a matter of time. Beans and meal closed higher and oil lower which has been happening more often than not. The meal/oil spread have been strongly in favor of the meal which is helping beans stay in a very strong uptrend. Beans made a new recent high close while meal had a new recent high and close. Oil had a large trading range and did manage to settle in the upper half although still down on the day. At least oil has been making higher highs and lows since the middle of March. I remain bullish on the entire grain complex (except for Rough Rice).

See the balance of my morning comments, including the Metals, Softs, Energies and Grains, at my website. For my complete coverage, visit my commentary page at www.markethead.com.

Rick Alexander has been a broker and analyst in the futures business for over thirty years. He is a Vice-President for Sales and Trading at the Zaner Group (www.zaner.com) a Chicago-based futures brokerage firm. If you would like a free booklet explaining the charts mentioned above, email Rick at ralexander@zaner.com.