What’s Up, What’s Down: Spotlight on the Financials and Energies Sectors

Comments for Tuesday, July 13, 2010

Looking Ahead to Today by Reflecting Back at Monday’s Price Action

FINANCIALS:

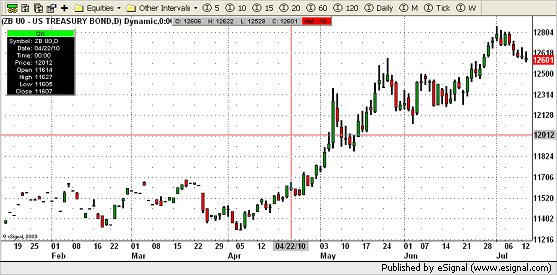

Slightly higher close Monday for the bonds while slightly lower for the Eurodollars and notes. The Eurodollar equaled Friday’s high making DOUBLE TOP that probably doesn’t mean much but still can’t be overlooked while in an uptrend overall. The notes and bonds were close to either side of unchanged with no changes technically. All of the indices continue to be in bull markets overall with the Sept. notes having support around the 12010 area and the bonds below 125.00. BUY SIGNALS FOR THE EURODOLLARS, NOTES AND BONDS. CALL FOR DETAILS!

ENERGIES:

Lower closes yesterday for crude and heating oil along with the RBOB and natural gas. The crude, heat and RBOB still look lower overall but my technical indicators are telling me to stand aside for now. Their present formations don’t give me a good indication at this time which way the energies are going to move. Gas continues to test its support from 420 to 460 basis the August contract making it difficult to take a short position at this time but is a sell nevertheless. SELL SIGNAL FOR NATURAL GAS. CALL FOR DETAILS!

There has been a lot of talk and advertising for Gold exchange traded funds (ETFs). Do you understand the difference, from a trader’s point of view, between gold futures and gold ETFs? Download my comparative evaluation report at https://www.zaner.com/3.0/ralexGold.asp.

Rick Alexander has been a broker and analyst in the futures business for over thirty years. He is a Vice-President for Sales and Trading at the Zaner Group (www.zaner.com) a Chicago-based futures brokerage firm. Email Rick at ralexander@zaner.com.

The information in this Report and the opinions expressed are subject to change without notice. Neither the information nor any opinion expressed constitutes a solicitation by Rick Alexander or the Zaner Group of the purchase or sale of any futures or options. Futures and options trading is speculative in nature and involves risks. Spread trading is not necessarily less risky than outright positions. Futures and options trading is not suitable for all investors.