What’s Up, What’s Down: Uptrend for Stock Indices

Comments for Wednesday, November 25, 2009

Looking Ahead to Today by Reflecting Back at Tuesday’s Price Action

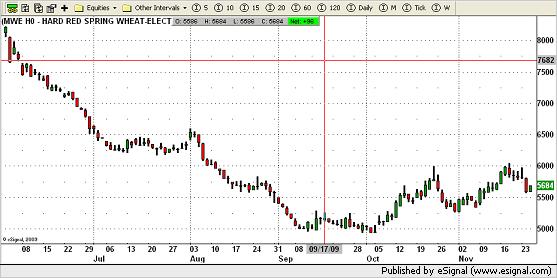

GRAINS:

Higher closes yesterday for rough rice, oats, soybeans and soyoil, mixed for soymeal while sharply lower for Minneapolis, Kansas city and Chicago wheat along with corn. All of the wheat continues to be in gradual up-trends overall but ending up sharply lower following through from Monday’s action as expected here. Corn also followed through lower as expected after Monday’s action like wheat selling off to close near its lows. The four dollar area continues to be the focal point for this grain. Rice closed higher again still in its last resistance with its KEY REVERSAL in tact but really acting strong overall. Oats also settled higher but has been making lower highs over the last two weeks while starting to act toppy. Still, oats are in a long-term up-trend overall. The beans complex settled higher shrugging off Monday’s similar action like the other grains by starting lower but, unlike the other grains, then rallying to close higher.

CURRENCIES:

Higher for the Japanese yen and Swiss franc while lower for the Euro Fx, British pound, Canadian and Aussie dollar along with the dollar index. The euro and franc continue to be in long-term up-trends both in choppy markets but acting like they will continue higher overall at this time. The yen settled higher after making its highest high since Oct. 9th still acting like it will test its October highs relatively soon. The Canadian dollar settled lower but still in an uptrend overall with support under 9400 basis the December contract but needing to close over 9600 to help verify a continuation of its move higher. The pound and Aussie dollar settled lower also still is in uptrends overall but the pound has been acting toppy and is in a BEAR PENNANT while the Aussie dollar has been making higher highs and lows. The dollar settled lower again still holding its own over the last three weeks but very bearish overall. A second close below 7500 could be devastating!

INDICES:

Lower closes on Tuesday for the cash and Dow futures along with the S&P’s and Nasdaq. All of the indices are still in up-trends and in small BULL PENNANTS continuing their up-trends.

See the balance of my morning comments, including the Metals, Softs, Energies and Grains, at my website. For my complete coverage, visit my commentary page at www.markethead.com.

Rick Alexander has been a broker and analyst in the futures business for over thirty years. He is a Vice-President for Sales and Trading at the Zaner Group (www.zaner.com) a Chicago-based futures brokerage firm. If you would like a free booklet explaining the charts mentioned above, email Rick at ralexander@zaner.com.

The information in this Report and the opinions expressed are subject to change without notice. Neither the information nor any opinion expressed constitutes a solicitation by Rick Alexander or the Zaner Group of the purchase or sale of any futures or options. Futures and options trading is speculative in nature and involves risks. Spread trading is not necessarily less risky than outright positions. Futures and options trading is not suitable for all investors.