Where the Traders Are: 3 Stocks for Swing Traders

Stocks are lower in the first hour of trading as a “buy the rumor, sell the fact” mood combines with dramatically overbought markets to encourage profit-taking early in the Wednesday trading session.

I thought today might be a good time to take a look at the stocks that short term swing traders are most interested in over the past 24 hours. The stocks in our Most Requested list this morning are an interesting mix of inverse exchange-traded funds and technology stocks but, more importantly, they also offer a contrast in stocks (and ETFs) with both high and low Short Term PowerRatings.

Unsurprisingly, the high Short Term PowerRatings side of the ledger is filled with inverse or short ETFs. Last night, reviewing potential trades for the TradingMarkets Battle Plan, I noted that among the candidates were a stunning variety of variations on the Russell 2000. Short and ultrashort, midcap, value and growth… just about every permutation of the inverse Russell 2000 made our watch list.

ProShares UltraShort Russell 2000

(

TWM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 4.46

Traders looking to speculate on the short side — or to hedge current positions against further downside, may want to pay particular attention to this exchange-traded fund.

Also unsurprisingly, the ranks of low Short Term PowerRatings names include stocks trading below their 200-day moving averages.

Potash Corporation of Saskatchewan

(

POT |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 2. RSI(2): 97.77

Undoubtedly an attractive stock due to its exposure to the commodity markets — particularly agricultural commodities, POT right now is among those stocks that have perhaps moved too far too fast to the upside. As such, POT is exceptionally overbought with a 2-period RSI of nearly 98. Recall that stocks with 2-period RSIs of 98 — and are trading below their 200-day moving averages — have tended to produce negative returns in the near term.

Lastly is a stock that is as deep in the “consider avoiding” territory as possible with a Short Term PowerRating of 1.

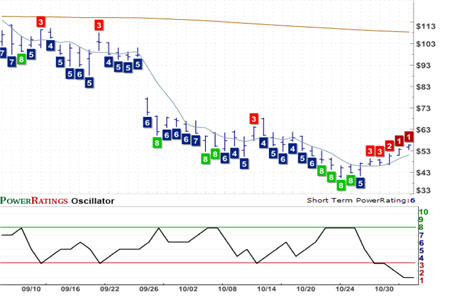

Research in Motion Ltd.

(

RIMM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 1. RSI(2): 97.44

Typically, the final few months of the year have provided bullish seasonality for technology stocks. Research in Motion has been in rally mode since late October, gaining more than 26% over the past nine days. Unfortunately, this rally has occurred below the 200-day moving average and resulted in a stock that is increasingly overbought with a 2-period RSI of more than 97. Because of this, we would add RIMM to that list of stocks that swing traders should be wary of being tempted into trading to the long side.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.