Which Way is Up? 5 Overbought Stocks for Traders

As many opportunities as we are seeing on the long side with stocks that have high Short Term PowerRatings, there remain plenty of overbought names that traders looking to bet against stocks might want to keep an eye on.

At almost all times, there are stocks that are rising and stocks that are falling. While the broader market certainly exerts a strong pull on stocks generally speaking, stock movement–at the end of the day–has more to do with attitudes toward the stock itself. The broader market often mutes or exaggerates those attitudes, making those ready to buy stocks all the greedier and making those ready to sell stocks all the more fearful. But when it comes to actually trading stocks in the short term, we believe that a stock by stock basis is the best approach.

This sometimes means, as is the case today, that there will be stocks that are pulling back and attractive as potential buys, as well as stocks that are bounding higher and attractive as potential short sales.

Let’s look specifically at the short side, for a moment. First and foremost, we look to short weak stocks. A hunting cheetah will seek out the weakest from among a herd when choosing its prey. Our attitude is similar. We want to bet against the weaker stocks in the herd, not the strongest.

For us, the weak stocks in the herd are the stocks that are trading below their 200-day moving averages. These are the smaller prey lagging behind the stronger ones in the pack that are trading above their 200-day moving averages.

Once we’ve spotted the weaker prey, how do we know when to strike? We like to wait for these weak stocks to show unusual strength, to act–even for a few days–like a strong stock. One of our 16 indicators that we publish at TradingMarkets.com looks specifically at consecutive up days–the signature of a strong stock–and shows us that when these consecutive up days occur in weak stocks, stocks that are trading below their 200-day moving averages, then what is otherwise the signature of a strong stock becomes the flimsy mask of a weak stock that can’t maintain the bullish charade any longer.

To read more about stocks making consecutive up days, click here.

We found that stocks that made five or more consecutive up days–and were trading below their 200-day moving averages–produced negative returns in one-day, two-day and one-week timeframes. When screened further for both low Short Term PowerRatings and high 2-period Relative Strength Index values, stocks that made five or more consecutive up days below the 200-day moving average become a rogues gallery of stocks that traders can wager against with confidence.

All of the stocks in today’s report have Short Term PowerRatings of 2–save for one. Our research found that stocks with Short Term PowerRatings of 2 have underperformed the average stock in five day’s time. Stocks with Short Term PowerRatings of 1 have actually underperformed the average stock by a margin of nearly 5 to 1 over the same time frame.

Note also that all of the stocks in today’s report have 2-period Relative Strength Index values of more than 98 and, in more than one case, more than 99, as well.

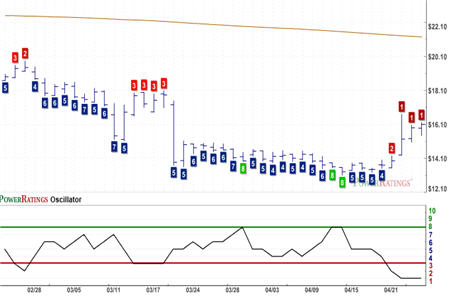

Centene

(

CNC |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 1. RSI(2): 99.24

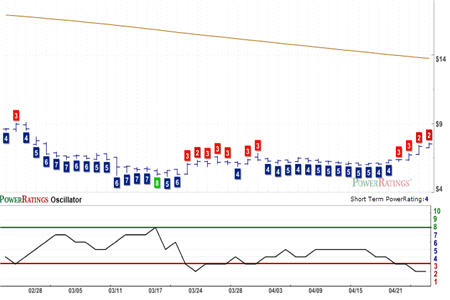

Fairpoint Communications

(

FRP |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 97.96

Netlogic Microsystems

(

NETL |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 99.32

Sprint Nextel

(

S |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 99.53

Systemax

(

SYX |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 99.38

Join Larry Connors, CEO and founder of TradingMarkets, Monday, April 28nd at 1 p.m. Eastern for a special presentation announcing the opening of our Swing Trading College. Our Swing Trading College has been one of our more popular products and we are happy to be making this 14-session, online course available to our readers and subscribers. The Conference Call will last for approximately 30 minutes.

Not only will Larry talk about the Swing Trading College, but also he will share with listeners a new method for swing trading exchange-traded funds, a strategy called “Double 7’s Strategy” that has performed impressively in historic testing, being correct over 79% of the time in both the NDX and the SPX from 1995 up through yesterday.

That’s Larry live Monday at 1 p.m. Eastern for the TradingMarkets Swing Trading College. Spaces are limited, so click here to reserve your spot today.

David Penn is Senior Editor at TradingMarkets.com.