While the USD Cats Are Away, the European Mice Will Play

During the holiday hours for the American non-labor Labor Day, while many U.S. traders were enjoying the sun and clutching to the last moments of summer and perhaps a William Wallace like ‘Freedom’, the European traders were busy selling any non-USD currency and the greenback enjoyed some significantly strong gains across the board.

There are almost too many important moves to talk about in a single article, but there is one pair which has inflicted some serious damage unto itself, the GBP. After almost every pair gapped at the open for the Asian session on Sunday, the GBP/USD around 5 p.m. PST broke through the huge psychological support at 1.8000 and has since gone on to crash 2 cents touching 1.78, and producing a modest bounce to 1.7861 at this writing.

What is most significant about this sell off in the GBP is that it’s not just happening against the USD, but against the CHF, JPY and pretty much every other currency including the Thai Baht and the Iraqi Dinar. That is not a resume filler these days and suggests some serious weakness in the GBP, so we are going to look at three GBP Pairs.

GBP/USD – Appealing to fibs: The low for the last 3 years in this pair is in 05′ just a hair above 1.70, and the high 2.1150. The 61.8% fib of this move has been obliterated at 1.8621 along with the 78.6%, suggesting a full retracement to the 1.70 handle is likely. Venturing further back with our fib. analysis, if we take the low over the last 10 years, in 2001, we clocked in around 1.3675 and the low to high fib for the 7 year bull run shows the 38.2% at 1.83 taken out and the next fib clocking in at 1.74 with

the last around 1.65. Thus, appealing to the fibs is not much of an appeal for the GBP bulls, suggesting 1.75 is a likely target along with 1.70 and 1.65. A break below their suggests a serious unwinding towards 1.55, thus there are huge implications to this sell off.

Lastly, using our Bollinger Band analysis in the chart below, a rare event is happening whereby the pair is walking the lower 2.5 STD band on the weekly chart and has been doing so for the last 4 weeks. Thus, if it closes this week outside the lower BB which is usually a continuation signal that would mean for 5 consecutive weeks it is closing outside the band, something that has not occurred in the last 10 years. This sell off in the GBP is for real and this trader suspects it could be quite larger than most people are guessing.

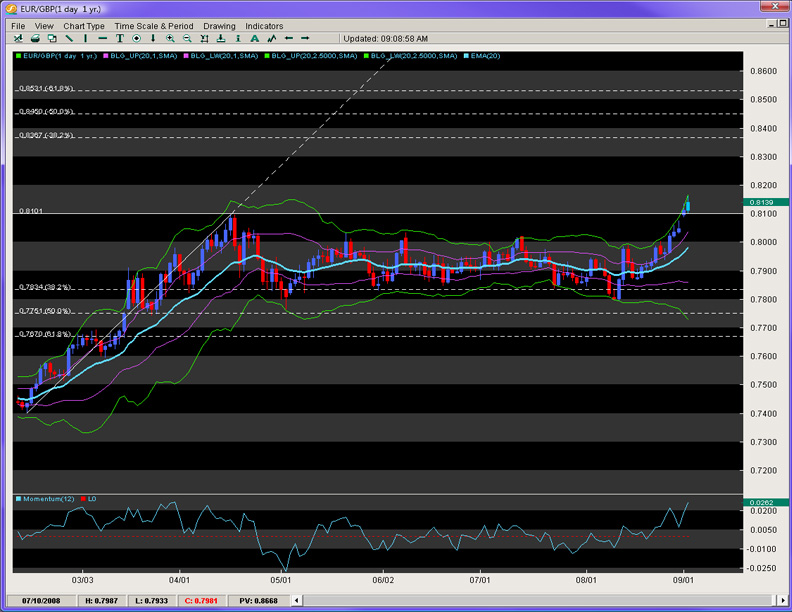

EUR/GBP: With the GBP selling off faster than Bear Stearns in the spring excitement for 08′, the EUR has been outpacing it as a better than worse GBP. This formula was a surefire recipe for the EUR/GBP to break the previous all time high at .8097 and is now sitting at 81.35 pence. Taking a look at the chart below, with daily momentum making new highs while still pointing up, upper BB’s expanding at a nice angle along with the 20 EMA pointing up at a 45 degree angle, it all suggests the current breakout is likely to continue. Where is it headed? I am glad you asked. With the absence of data in these stratospheric levels and land of the all time highs, fib extensions can often give us some great price targets.

During the last bull run for this pair, climbing from .7400 to .8100, the pair settled mostly above the 38.2 at .7834 and almost touched the 50% fib at t.7753, so it seems fair to assume an upside extension around the 1.50 fib perhaps giving it a kiss and then selling off. That extension currently lies around .8445 and the 38.2 is posting up at .8363 offering some good upside targets.

GBP/JPY: This feels like it could have the most serious unwinds in the near future and we are turning to both Ichimoku and Fibonacci models to give us clues as to how far – how fast this pair could, and likely will dive.

Tuning into the weekly charts, we are inches if not hours or pips away from the pair activating a Strong Sell Signal via Ichimoku charts. Currently, the Tenkan line (white) is only 6 pips above the Kijun line (red) and a bearish crossover is the first filter to create a sell signal. Where the crossover occurs helps to determine the strength of the signal, and as you can see in the chart below, it’s occurring below the cloud (Kumo) which is regarded as support/resistance levels. Thus, if the sell signal is occurring below support which has been cleared, the signal is considered to be a strong sell signal. Furthermore, using fib models, from the 07′ – 08′ credit crunch sell off (251.00 – 192.51) which was a whopping 5,850 pips, the pair retraced handsomely to the 38.2% fib, stopped there and closed that week, only to open the next day, go 10 pips up, then sell off for 5 weeks in a row (2000 pips later)

and this potentially being the 6th week of straight declines.

Over the last 10 years, the pair has only posted two other 6 week declines, with one of them only matching the force or intensity. That being said, a weekly close below our 08′ lows at 192.39 would likely produce the strong Ichimoku sell signal and likely target the 1.382% fib extension which lies at a very tidy big figure of 170, thus offering a potential 2200 pip trade opportunity.

Chris Capre is the Founder of Second Skies LLC which specializes in Trading Systems, Private Mentoring and Advisory services. He has worked for one of the largest retail brokers in the FX market (FXCM) and is now the Fund Manager for White Knight Investments (https://WhiteKnightFXI.com). For more information about his services or his company, visit https://2ndSkies.com.