Why Higher Prices for the EUR/USD May Be Ahead

At the time of this writing, the EUR/USD is up almost 400 pips on the day and if I write this long enough, I will have to adjust that figure. It currently sits at 1.4375 just below the M4 pivot at 1.4445 and has clearly broken out of its earlier slumber with a Bruce Willis Die Hard Vengeance.

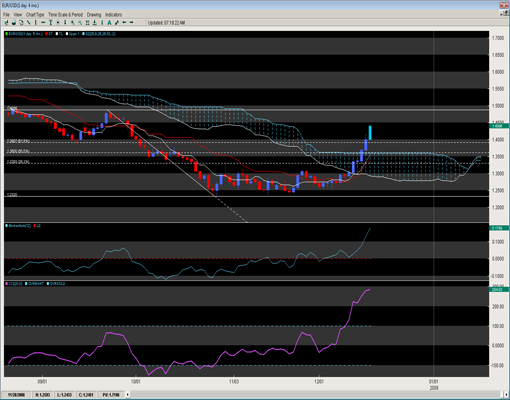

Starting with the Daily Ichimoku Cloud picture below, the pair has not only punched through the cloud but also taken out the 78.6% fib of the 1.4866 late sept. swing high to the yearly lows at 1.2330ish. This suggests a full retracement is now likely once we get past the 1.45 big figure with the line of least resistance clearly to the upside in the short/medium term.

Taking a closer look at the intraday charts, we can see how the Bollinger Bands gave us the typical squeeze pattern with the pair jumping out of the pocket on a 200+ pip tirade. The first 30m close outside the 2.5STD BB suggested continuation and that is exactly what has happened in the following candle.

As long as the pair continues to close outside the 2.5STD BB on the 30m time frame, we expect the upside pressure to remain.

Chris Capre is the Founder of Second Skies LLC which specializes in Trading Systems, Private Mentoring and Advisory services. He has worked for one of the largest retail brokers in the FX market (FXCM) and is now the Fund Manager for White Knight Investments (www.whiteknightfxi.com/index.html). For more information about his services or his company, visit www.2ndskies.com.