With the FOMC decision looming; know your technical levels

Dave Floyd is a professional FX and stock trader based in Bend, OR and the

President of Aspen Trading Group. Dave’s approach to FX combines technical

and fundamental analysis that results in trades that fall into the swing

trading time frame of several hours to several days. For a free trial to

Dave Floyd’s Daily Forex Alerts

or call 888.484.8220 ext. 1.

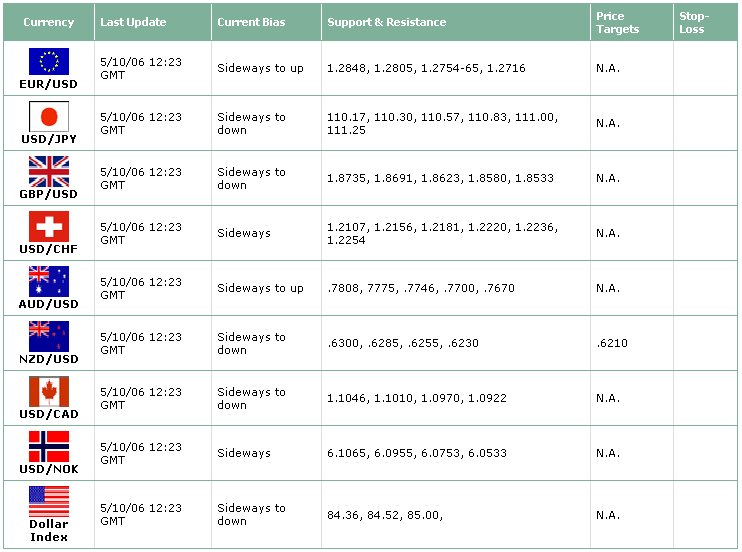

While the technical levels below will remain valid during

today’s trading session, bear in mind that the ‘Current Bias’ column may not be

valid post-FOMC as price action will be volatile and the content of the

‘statement’ may well alter the current price direction.

Referring to

yesterday’s article you will notice how CHF/JPY

has begun to sell-off overnight – we still see lower levels in the days ahead.

The template below contains

‘support’ and ‘resistance’ levels for the major FX pairs – note these levels on

your charts and see how they can assist you in entering and exiting

trades. There are no ’24-Hour Target Trades’ for today as we do not see any

set-ups that meet that criteria due to the FOMC decision.

Wednesday’s FX Targets & Technical Levels

Get a live sampling of our intra-day analysis and trade

alerts via our

FX

Desktop Ticker

As always, feel free to send me your comments and questions.Â