Connors Research Traders Journal (Volume 57): 7 Real-World Reasons Why Short Strategies Should Be Included In Your Portfolio

In our new book, The Alpha Formula – High Powered Strategies to Beat the Market with Less Risk, we show the benefits of including short-strategies in your portfolio.

As a reminder, building portfolios should be based on First Principles – otherwise known as truths. These truths are:

- Markets Go Up

- Market Go Down

- Markets Go Through Times of Stress.

In the previous issue of the Connors Research Traders Journal, we showed data-driven reasons why owning treasuries for a portion of your portfolio is one of the best, if not the best investment one can make for when markets go through times of stress.

In this issue, let’s look at the 7 reasons why you should include short strategies in your portfolio.

7 Reasons For Being Dynamically Short With a Portion of Your Capital

1. Markets Go Down – Period!

This one is rather obvious – bear markets are a part of investing life.

While it would be nice to buy stocks and watch them go up forever, this is not the case in the real world. Going back to First Principles, or objective truths, we know that bear markets are a fact of life.

In fact, here in the US, we have had two rather severe bear markets over the last 20 years, with the S&P 500 getting cut in more than half both times!

This has happened before and it will happen again; have a strategy (or strategies) in your portfolio to profit from such times!

2. Great Wealth Has Historically Been Created on Timely Short Positions

There are numerous stories of great wealth being created from properly timing short positions. You only have to go back and read Michaels Lewis’ great book “The Big Short” to see how millionaires and even billionaires were minted by capturing the 2008 market decline.

There’s no guarantee that an event like that will occur again, but markets have a history of repeating themselves. And now will the many instruments available to be short markets, countries, and sectors, along with more liquid derivative products available, the opportunities are potentially the greatest they’ve ever been in history.

3. Short Strategies Often Lower the Volatility of Your Portfolio

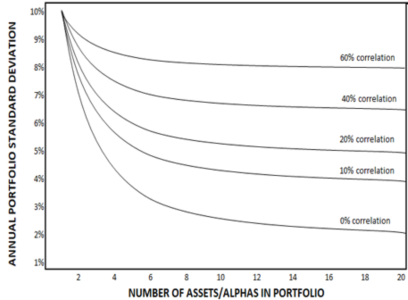

This is a big one. Having a strategy designed to profit from global bear markets will naturally be uncorrelated, and at times negatively correlated, with other strategies in your portfolio.

This non-correlation has the effect of lowering the volatility of your portfolio as a whole, greatly decreasing your risk.

Billionaire Ray Dalio called this insight “the holy grail of investing” and is the main insight he points to for this dramatic success.

Simply put – adding uncorrelated trading strategies decreases your risk while not diluting your returns. The net result is an often dramatic increase in risk-adjusted return metrics such as the ubiquitous Sharpe Ratio.

The graph below shows this phenomenon:

4. There is Usually a Bear Market Somewhere in the World

US-based investors might mistakenly think that there hasn’t been a major bear market since 2008. While that may be true of the US, there has been plenty of places around the world that have experienced bear markets and severe equity declines.

Go take a look at the chart of Greece, or Brazil, or China, or Russia, just to name a few. All of these markets have experienced periods of significant declines post-2008.

There is usually a bear market somewhere in the world. Have a strategy designed to take advantage of these market declines wherever they may occur.

5. Apply a Market Regime Filter

As mentioned above, equity markets tend to be in bull mode for the majority of the time. During such times, a short only strategy designed to profit from bear markets will be a major drag on performance.

Given this fact, we are big fans of having an overall regime filter to turn a strategy “on” and “off” based on market conditions.

This regime filter can be as simple as turning our short strategy “on” if a market is below its 200-day moving average, or if a market is showing a negative total return over the last six months, just to give two examples.

This regime filter allows us the potential to profit from times when markets go down but not have that strategy be too much of a drag when markets trend higher.

6. Bear Market Rallies Create Good Short Opportunities

One universal characteristic of bear markets is that they tend to have higher volatility compared to bull markets. Connors Research has published this fact for a number of years in our books and also in our Swing Trading College.

The table below displays the volatility of the Wilshire 500 index (a very broad index of US stocks) when the index is above and below its 200-day moving average.

Notice the higher volatility when stocks are below their 200-day MA, in this case, more than double.

You can use this heightened volatility to your advantage.

For instance, what is common to see in bear markets is dramatic, short-covering rallies. Ironically, one-day rallies are often stronger in bear markets as opposed to bull markets because of the increased volatility displayed above.

We can use these strong, short-covering bear market rallies to set up our short positions, as these rallies are usually short-lived and the prevailing downtrend tends to resume.

7. Shorting “Overvalued” Stocks Has Been Very Difficult – Combine Price Action with Fundamentals!

Shorting stocks just because they are viewed as “overvalued” is a very difficult and often losing game. These overvalued stocks can continue higher, often in a dramatic way, for years on end. Not only has this been very evident in the recent bull run here in the US, it’s been the history of equity short selling for decades.

Wall Street is a graveyard of fundamentally oriented short only managers!

Instead of relying only on fundamentals – we prefer to use either price action only, or price action combined with certain fundamental factors.

We are currently doing some interesting research in this area – identifying companies that are at risk of a large decline because of fundamental factors; then using price action to inform us when to execute the trades.

Stay tuned for more “quantamental” research on this. There’s potentially a lot of upside here with this “quantamental” approach.

Conclusion

One of our First Principles, or objective market truths, is that markets decline. We want to have at least one strategy in our portfolio to profit from such an event.

Above we listed 7 reasons why this is beneficial. We encourage you to consider a bear strategy for a portion of your portfolio as well.

More Knowledge To Improve Your Trading

There Is No Future For Traders Who Don’t Know Python – efinancialcareers.com

The majority of the professional trading desks around the world are requiring their traders to create and test their strategies using Python (not Amibroker and TradeStation). They’re doing this because Python allows their traders to build better strategies faster, and more efficiently, with the objective of increasing profits.

Please listen to this webinar and join the largest and fastest-growing community in the investment world who now test and program their strategies in Python. This webinar discusses how and why Python will improve your trading.

2. Become a Master Swing Trader in 10 Weeks… click here for more information

The passive investment industry states there is no Alpha in the markets. This book proves them wrong!

The Alpha Formula – High Powered Strategies to Beat The Market With Less Risk teaches you strategies and portfolios with historical Alpha in Stocks, ETFs, and Fixed Income.

Backed by many quantified, systematic strategies, dozens of academic studies and combining behavioral finance with Ray Dalio’s correlation research, this book will teach you new, easy to understand quant strategies you can apply immediately.

Larry Connors & Chris Cain, CMT