How to Take Profits From the Bull & 3 PowerRatings Stocks

The old, grizzled real estate millionaire took me aside during my first disastrous foray into low end investment properties. In a raspy, smoke damaged voice he intoned, “Young man, your mistake was not knowing when and how you were going to sell BEFORE you bought this building.” I countered with, “But I bought it at a good deal and followed all the buying rules.”

Getting visibly agitated, he stated, “Never forget that profits and losses are only locked in when you sell, selling right is more important than buying right.” Those words have stuck with me over the years and are perhaps even more applicable to the stock market than real estate. Due to the liquid nature of the stock market, selling is perhaps even a more important factor in stocks than it is in real estate.

We have studied successful exit methods to determine the optimum way to take profits from a trade. As you are aware, we are strong believers in buying weakness and selling into strength. Entering the trade with an edge, and then exiting when the edge hits its maximum benefit, prior to it dissipating, is the key to profitable trading. This is exactly how market makers, specialists and professional traders whack up the consistent profits year after year regardless of market conditions. Our research looked at 5 different exit strategies that are as follows:

1. The Fixed Time Exit Strategy: This method relies on exiting a trade after a fixed period of time. It does not take into account the basic underlying tactic of buying into weakness and selling strength.

2. The First Up Close Strategy: A tactic that exits after the stock has its first up close versus the previous day. Larry Williams came up with the idea and it still performs well to this day.

3. New High Exit Strategy: Exit the trade after it closes above a new high. A 7-day high was used in testing. The results were nicely better than the fixed time exit strategy.

4. Close Above the Moving Average Strategy: A 5-period MA and a 10-period MA were used in the tests. Strong performance was noted with this method.

5. Period RSI Strategy: The 2-period RSI plays a critical role in our entry methods. It also makes sense to use this indicator when exiting. When the RSI(2) closes above 65, 70, or 75 it indicates a optimal exit time.

The statistics behind each of these tactics can be found in Larry Connors’ book Short Term Trading Strategies That Work.

Here are 3 PowerRatings Stocks primed for short term gains.

^OREX^

^CLW^

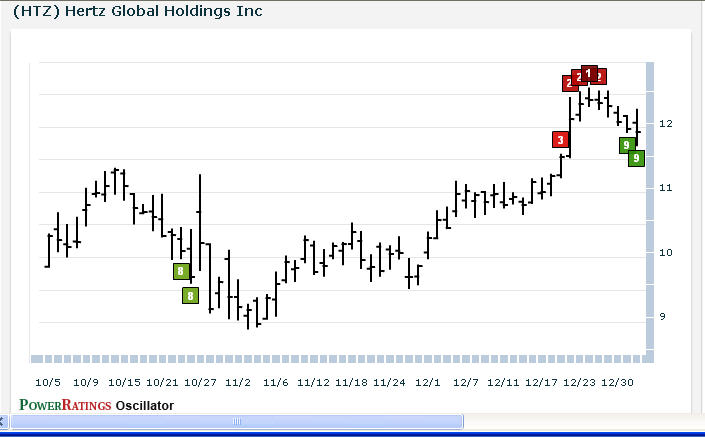

^HTZ^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.