Connors Research Traders Journal (Volume 49): When Markets Panic Investors Herd Into Treasury Bonds

Here Is The Number One Reason Why You Should Always Have A Portion Of Your Portfolio In Treasuries!

One of the core themes of our new book, The Alpha Formula – High Powered Strategies to Beat the Market with Less Risk, is to build an investment portfolio by attacking First Principles or objective, self-evident truths.

Ideally, we would want to have at least one strategy in our portfolio designed to…

- Profit when markets go up

- Profit when markets go down

- Profit when markets go through times of stress

In this issue of the Connors Research Traders Journal, we are going to focus on the last First Principle – how to profits when markets go through times of stress.

When Risk Markets Go Through Times of Stress, Investors Herd Into Treasury Bonds

This commentary is certainly timely. These last two weeks have seen some dramatic, market-moving events causing an increase in volatility.

From the Fed not being dovish enough to President Trump’s surprise 10% tariff on additional Chinese goods to the Yuan devaluation, the US equity markets have been on edge after a slow grind higher throughout most of 2019.

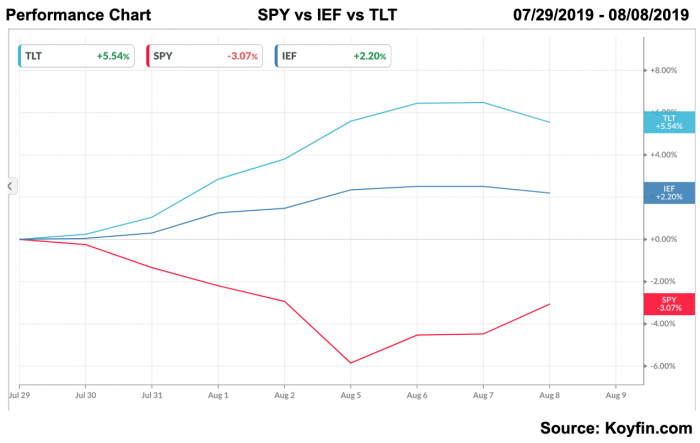

First, let’s investigate the performance of SPY vs IEF (7-10yr US Treasury bonds) and TLT (20yr+ US Treasury bonds) over these last 2 volatile weeks…

This type of volatile equity market action, while at times unsettling, is completely normal. Equity and other risk markets routinely go through times of acute stress. This is why this objective fact is included in our First Principles.

How do investors typically react when equity markets go through short term pain? They typically herd into assets that are perceived as safe havens. The most reliable safe-haven asset to own when markets go through times of stress is US Treasury bonds.

This is evident by the strong performance of both IEF and TLT over the last two weeks.

US Treasuries – The Ultimate Safe Haven Asset

The major benefit of adding US Treasuries to your portfolio is, not only do they tend to be low to negatively correlated with equities over time, but they also get very negatively correlated when equity markets react strongly to the downside. This is a negative correlation when you need it most!

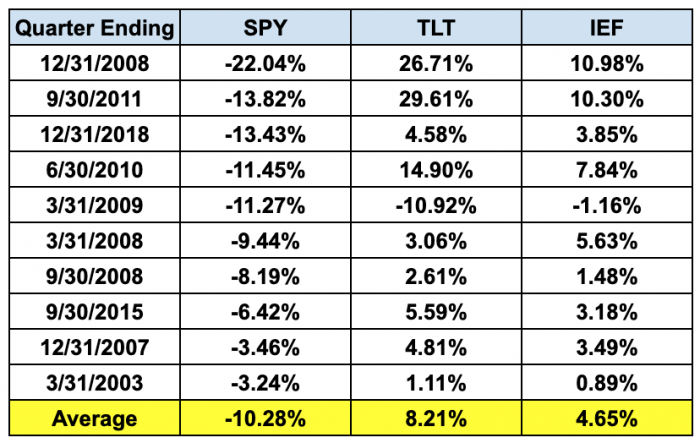

To quantify this, let’s check out the worst quarters for SPY and observe the performance of both IEF and TLT.

This analysis spans July 2002, the inception date for both IEF and TLT, to present.

IEF vs TLT

Both IEF and TLT give investors exposure to US Treasuries. The difference between the two is the duration of the portfolio.

IEF invests in bond in the 7-10yr part of the curve and has a duration of 7.5 years.

TLT invest in bonds in the 20yr+ part of the curve and has a duration of 18 years.

The most straightforward and practical way to think about duration is as a measure of the sensitivity of a bond’s price to changes in interest rates. Simply put, bonds with longer durations will move more while bonds with shorter duration bonds will move less.

Worst Quarters

Below find the worse quarters of SPY and the subsequent performance of both IEF and TLT.

Notice how US Treasury bonds catch a consistent safe-haven bid when equity markets decline. The average decline for the 10 worst quarters for SPY was -10.28% compared to an average increase of +8.21% and +4.65% for TLT and IEF during these same quarters.

Also, notice the high consistency of these results. TLT and IEF increased in value in 9 out of the 10 worst quarters of SPY, with the only exception being Q1 2009, a “batting average” of 90%!

Summary

Investor’s tendency to herd into the perceived safety of US Treasuries was on full display during the market volatility of the last two weeks. This is typical behavior, as evidenced by observing the worst quarters for SPY and the subsequent performance of IEF and TLT.

The bottom line – always have US Treasuries as part of your portfolio to profit from times when market panic!

In The Alpha Formula – High Powered Strategies to Beat the Market with Less Risk, we make a compelling case as to why treasuries are a great safe haven asset you can use to protect and also grow your money during times of market stress. We also go further, presenting our Connors Research Dynamic Treasuries Strategy, designed to dynamically adjust duration based on market trends. This knowledge will make your portfolio more robust and able to stand up to short term panics!

If you’d like to order your copy of The Alpha Formula – High Powered Strategies to Beat the Market with Less Risk, you can click on this link. The book has received great feedback.

Join Us Tuesday

If you’d like to learn more about what Python can do to improve your trading, you can sign up for a free 45-minute webinar we’re holding this Tuesday at 1 pm ET. To register, please click here now.

PS – Each of the strategies and the portfolios that are presented in The Alpha Formula – High Powered Strategies To Beat The Market With Less Risk was done in Python.

Could they have been done in other languages? To a degree. But the professional trading firms including many of the largest and best asset management firms and hedge funds have their traders and researchers build their strategies in Python. At the webinar, we’ll show you how you can too! Click here to register now.

Chris Cain, CMT