Connors Research Traders Journal (Volume 56): Further Proof Why Owning Treasuries In Times Of Stress Is a Superior Strategy

Would you like the opportunity to profit when markets go through times of stress? Here’s how.

US Treasuries – The Universal Investment of Choice In Times of Stress

In our new book, The Alpha Formula; Beat the Market with Less Risk, we introduced the idea of constructing portfolios through the lens of First Principles.

In the book, we showed why you ideally want to construct your portfolio with strategies that:

- Participate in rising equity markets.

- Participate in declining equity markets

- Participate when markets go through times of stress.

Today let’s look at the number 3 above because it’s so timely.

In our book, we introduced the Connors Research Dynamic Treasuries strategy. This strategy assures that your portfolio always has a portion of your money in treasuries.

This is done because when markets go through times of stress, historically, treasuries have rallied, protectingone’s portfolio.

During these times, there’s historically been a “flight of safety” into treasuries, as investors herd into perceived safe assets. We’ve seen this for decades and especially have seen this in 2019.

Updated Results

Our test results in the book ran from 2007-2018. Today we’ll share with you the results for 2019 up through August 27, 2019.

What you will see is significant outperformance in a bull market for bonds, and also outperformance this year versus many of the top “bond fund kings”. https://finance.yahoo.com/news/three-u-bond-kings-wield-050317719.html

The Strategy

Our Connors Research Dynamic Treasuries strategy, as the name implies, dynamically rotates in treasury bonds of differing maturities depending on market trends. We use four popular treasury bond ETFs to gain exposure to this asset class, lengthening or shortening the duration based on the market action.

In this Connors Research Traders Journal, we will look at the historical performance of US Treasuries during stressful times for the overall US Stock market. The strong historical performance of this safe-haven asset during times of stress for equities is the main reason why this strategy is included in The Alpha Formula portfolio.

We will then update the test results displayed in the book, which ended in December 2018.

US Treasuries – The Ultimate Safe Haven Asset

US Treasuries have been one of, if not the most consistent asset to catch a safe haven bid when US equity and other risk markets go through times of stress.

As a quick quantification of this phenomenon, we studied the performance of US Treasury bonds during the worst quarters of US Stocks over the last 15 years. Here is the table summarizing the results:

It’s s clear to see that US Treasuries consistently catch a safe haven bid when US stocks are experiencing short-term stress. Notice the average return for the 10 worst quarters for SPY was +8.21% for TLT (20yr+ Treasury Bonds) and +4.65% for IEF (7-10yr Treasury Bonds).

The Bottom Line – Always having an allocation to US Treasuries pays off in a large way when US markets go through stress.

2019 Performance

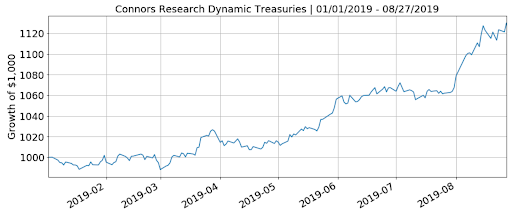

Below we updated the 2019 performance of our Connors Research Dynamic Treasuries strategy, one of the four strategies we present in The Alpha Formula.

This strategy invests in US Treasury bonds of different maturities based on market trends, looking to be in longer-term maturities when bonds have been strong and shorter-term maturities (to preserve capital) when bonds have been weak.

Obviously, 2019 so far has been a watershed year for the fixed income markets, with bonds around the world consistently heading higher in price (lower in yield). As such, our Connors Research Dynamic Treasuries strategy has been invested in longer maturity bonds throughout most of the year. By investing in bonds with long maturities, we maximize the capital appreciation of our bonds when interest rates head lower.

Full disclosure of the rules for this strategy is contained in The Alpha Formula book.

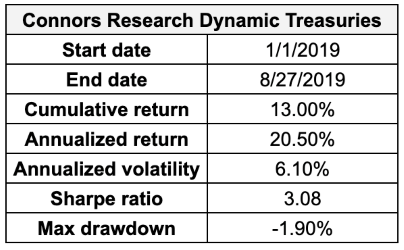

Here are the 2019 test results through 8/27/19 of our Connors Research Dynamic Treasuries strategy:

So far this year the Connors Research Dynamic Treasuries model has outperformed IEF (7-10 year treasuries) by approximately 240 basis points (2.4%)

Conclusion

No one (except the people on TV) knows how much longer this bond bull market, which has largely been in place since the 1980s, will run. We strongly recommend dynamic strategies for fixed-income exposure, allowing one to potentially profit if there is a strong bull trend in bonds (like 2019 so far) and to protect fixed income capital should that reverse.

If you would like to learn more about this strategy, you can find it in our new book, The Alpha Formula; How To Beat The Market With Less Risk.

More Knowledge To Improve Your Trading

There Is No Future For Traders Who Don’t Know Python – efinancialcareers.com

The majority of the professional trading desks around the world are requiring their traders to create and test their strategies using Python (not Amibroker and TradeStation). They’re doing this because Python allows their traders to build better strategies faster, and more efficiently, with the objective of increasing profits.

Please listen to this webinar and join the largest and fastest-growing community in the investment world who now test and program their strategies in Python. This webinar discusses how and why Python will improve your trading.

2. Become a Master Swing Trader in 10 Weeks… click here for more information

The passive investment industry states there is no Alpha in the markets. This book proves them wrong!

The Alpha Formula – High Powered Strategies to Beat The Market With Less Risk teaches you strategies and portfolios with historical Alpha in Stocks, ETFs, and Fixed Income.

Backed by many quantified, systematic strategies, dozens of academic studies and combining behavioral finance with Ray Dalio’s correlation research, this book will teach you new, easy to understand quant strategies you can apply immediately.

Larry Connors and Chris Cain, CMT