Connors Research Traders Journal (Volume 63): Here are the Historical Edges with “Weekly” RSI

For the past 15+ years, we’ve been publishing extensive research on the 2-period and 4-period RSI.

Even though Welles Wilder created the original research for RSI in the 1970’s using a 14-period RSI, the indicator was basically unused by traders 15 years ago. Now it’s ubiquitous with technical traders, especially on a daily reading basis.

What’s less well-known is how well the shorter-term RSI works on a “weekly” basis. We’ve created a number of strategies using the weekly RSI including the S&P Weekly Strategy taught in our new book, The Alpha Formula.

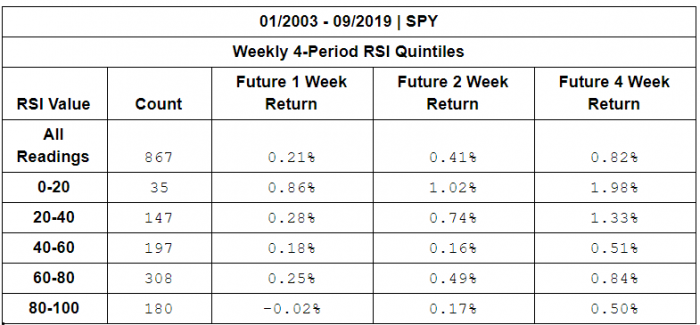

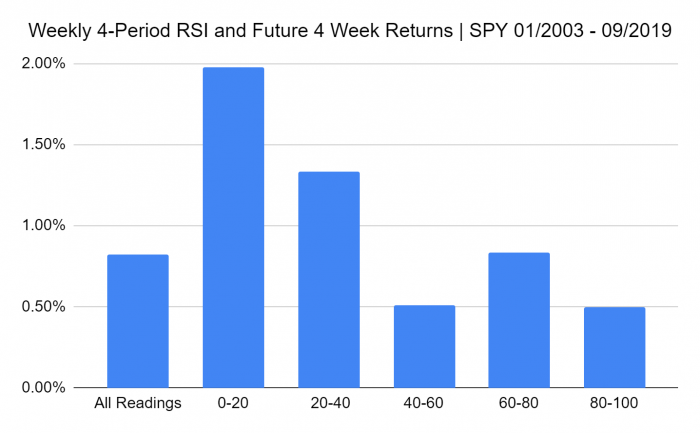

Today we want to share with you updated test results on SPY applying the weekly 4-period RSI from 2003 through mid-September 2019.

Here are the Test Results

The test results are clear (and this is what we’ve seen consistently for over a decade and a half of published research). Edges exist when a shorter-term RSI reading gets below 20, especially in the S&P 500 (in this case with the SPY ETF.).

These edges can be expanded through the use of applying dynamic price exits (crosses above short-term moving averages. and oscillators especially).

The key takeaway from these test results is that shorter-term RSI readings, especially in US equities have had edges both on a daily basis and a weekly basis. No indicator is perfect but few, if any, have continued to show the sustained historical edges that RSI has.

More On RSI

In our upcoming Quantamentals Course, we’re going to teach how to combine technical analysis edges like you see here with RSI, with fundamental analysis, and quantitative analysis. When you combine all three together you’re stacking edges and getting the best of all worlds in your strategies.

To listen to the webinar on Quantamentals and how it can improve your trading, please click here.

As always, we enjoy your feedback. Please send it to either of us at lconnors@connorsresearch.com or ccain@connorsresearch.com

Larry Connors and Chris Cain, CMT

P.S. – Receive Trading and Investing Research from Connors Research! To subscribe to The Connors Research Traders Journal, please click here.